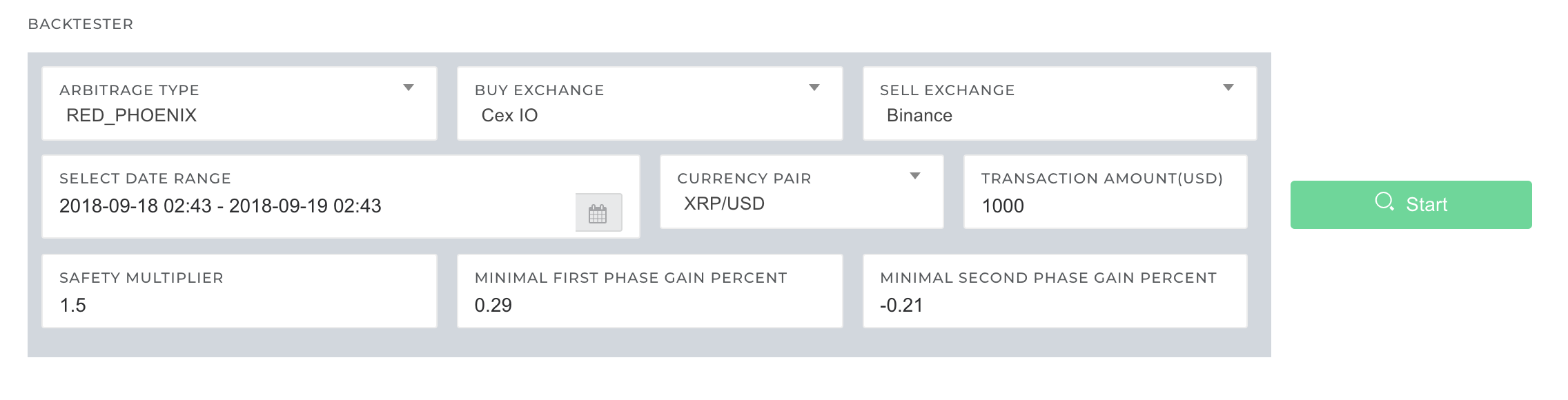

Each of available arbitrage strategy has some parameters. In order to configure a bot to use each of strategies you need to provide some parameters:

- for oscillator – you need to provide gain that triggers the trade (if the gain from pair of trades – buy on exchange A, sell on exchange B) is greater than provided value, the bot decides to execute the trade

- for loop – same stuff

- for red phoenix – you need to provide two parameters – one is minimum gain in order to buy on A, sell on B, second parameter is a gain (or rather a loss) when you want the bot to “trade back” – that is to sellback on A and buyback on B.

With backtester you may check what would be the outcome if you would set up a bot with given parameters for some period in the past. Until now the backtester has been hidden behind the command line. Now you can try this with any params you wish.

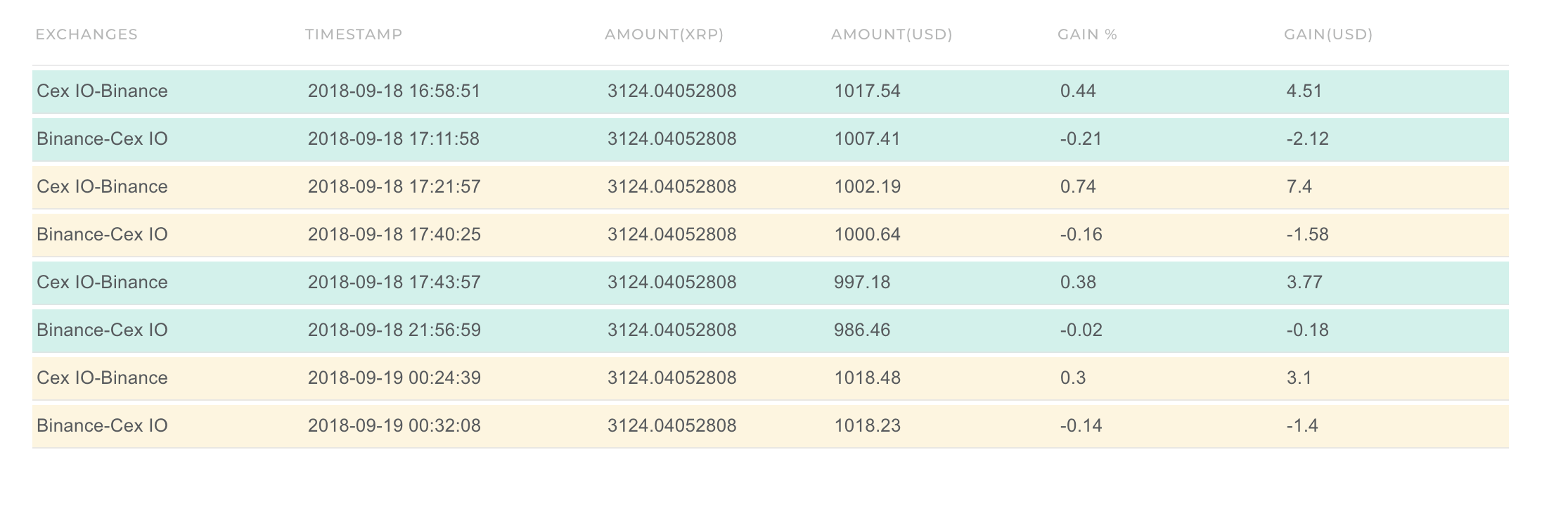

As the outcome of the backtester we have two things:

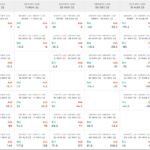

chart representing the arbitrage analysis with highlighted moments when the bot would be executing the trade

Each row here represents the trade pair (buy on exchange A, sell on exchange B). On the screenshot above you can see the outcome of the backtester for red phoenix. In red phoenix you have two trade pairs – first trade pair when you gain, second trade pair when you loose a bit – this is why the list has background color highlighting trade sets.