Find our full article on Introduction to futures spread trading on Medium.com

What is spread?

Spread is price difference between two futures contracts. This difference is not constant and depends on couple of factors (to which we will come back later)

What is futures spread trading?

Futures spread trading is type of market-neutral strategy where the investors seek to profit from the change in the price differences — the spread price — between two positions — short and long — on the two futures contracts on the same asset with different delivery dates, or on the two futures contracts on different assets that are price correlated to each other with the same delivery date.

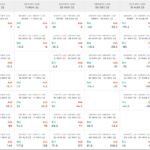

Calendar Spreads

Calendar spread traders are primarily focused on changes in the relationship between the two contract months.

How to buy the spread?

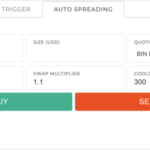

Buying the spread means buying first contract and selling the second contract at the same time. Selling the spread is the opposite operation – selling first contract and buying the second

How to Profit

We buy the spread, when the spread price is low and we sell the spread when its price is high.

Find our full article on Introduction to futures spread trading on Medium.com