What is it?

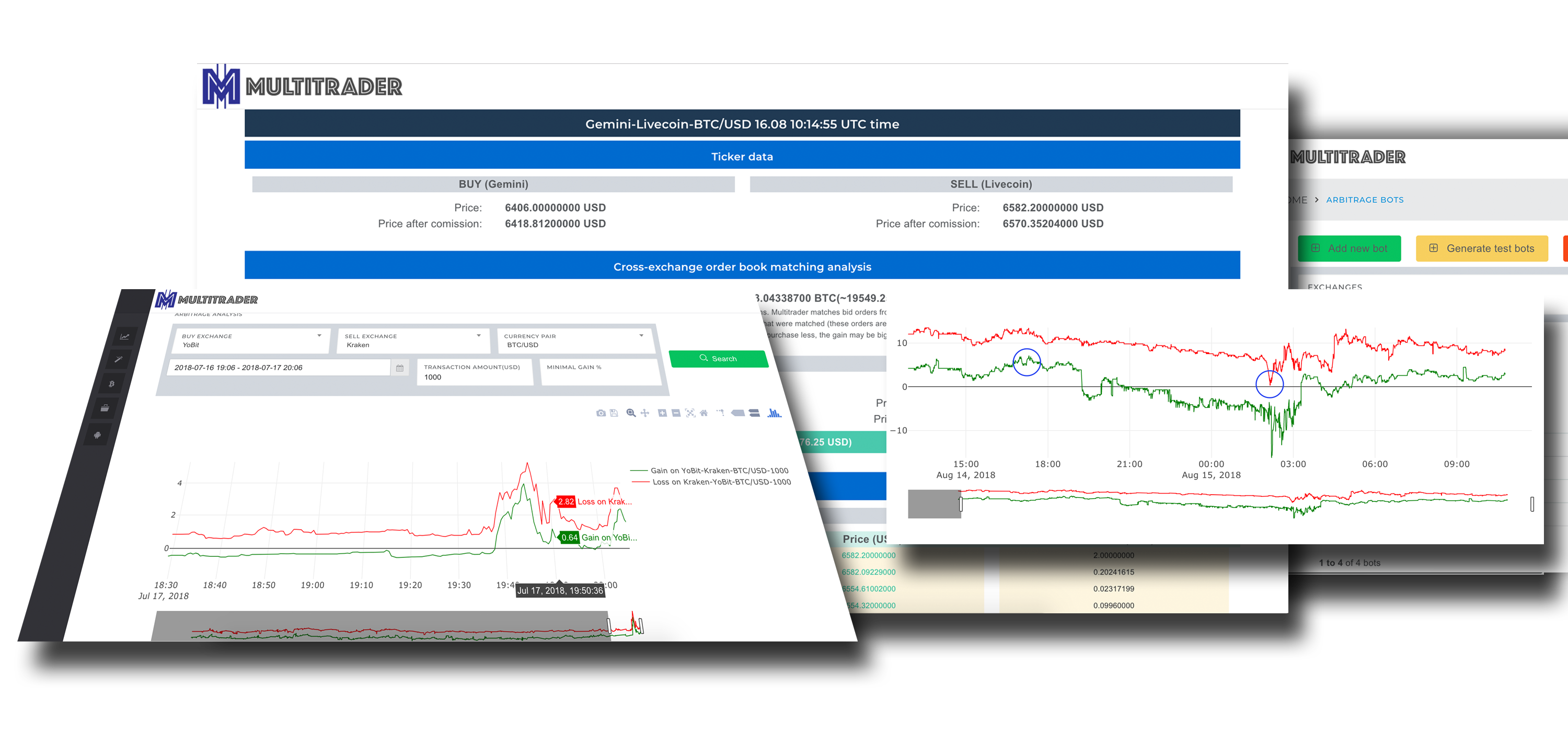

MultiTrader is cryptocurrency arbitrage trading platform. It constantly monitors 90 currency pairs across 15 exchanges. In case the price of some currency on one exchange is lower than its price on second exchange, MultiTrader performs more detailed analysis to make sure this is real arbitrage trade opportunity. MultiTrader streams the list of current arbitrage trade opportunities and allows users to browse through the current and historical arbitrage trade opportunities.

Platform user interface allows users to browse through the current and historical prices and to view all the prices of given currency pair from multiple exchanges on the single chart. Users can perform detailed arbitrage opportunity analysis with the use of current and historical order books.

Users can define trading bots with customisable trading strategies. MultiTrader supports three arbitrage trading strategies. Bots take decisions to buy or sell based on the user provided strategy parameters. MultiTrader helps to find out the most optimal parameters for the bots with the functionality of back-testing and the optimiser.

Furthermore the platform helps users to monitor their funds, sends detailed bot activity reports, provides info about exchange availability status and many more…

Exchange Integration

MultiTrader has integration with 15 cryptocurrency exchanges:

- Kucoin

- Binance

- Poloniex

- Bitstamp

- Kraken

- GDAX (Coinbase PRO)

- Yobit

- Wex

- Livecoin

- Gate.io

- Bitbay

- Gemini

- Cex.io

- Cryptopia

- ANXPRO

Exchange Integration Layer provides set of functions that are common across all the exchanges:

- reading ticker prices for all currency pairs

- reading order books

- placing order requests

- checking user operations history and trade history

- checking funds in wallets

- withdrawing funds from wallets

You can find more details about it in the article about Exchange Integration Layer.

Ticker price and order book monitoring

MultiTrader connects to all the exchanges right after it is started and monitors ticker prices and order books. MultiTrader stores historical ticker prices and order books, so that the users can browse that data, display charts and perform back-testing.

Multi-exchange charts

This function is dedicated for basic analysis of the market situation – kind of reconnaissance before actual arbitrage opportunity analysis.

It allows user to view the aggregation of the ticker prices of given currency pair from couple exchanges on single chart. In fact each ticker consists of two values – this is BID and ASK price. BID price is how much you can get if you decide to sell on the exchange. ASK price is how much you will pay if you decide to buy. In reality you may pay a bit when buying or get less when selling in case your order size exceeds the size of the order that is offered with given BID/ASK price. The ticker prices do not take under account commissions.

MultiTrader allows users to browse through both BID and ASK prices for each exchange, you can combine charts from as many exchanges as you want.

Arbitrage opportunity monitoring

For each currency pair, MultiTrader constantly iterates through the most recent prices from all the exchanges that offer given currency pair, to find arbitrage opportunities

In case the MultiTrader spots that the ticker price on one exchange looks promising compared to the ticker price on another exchange, it performs full cross-exchange order book matching to check if this is real arbitrage opportunity.

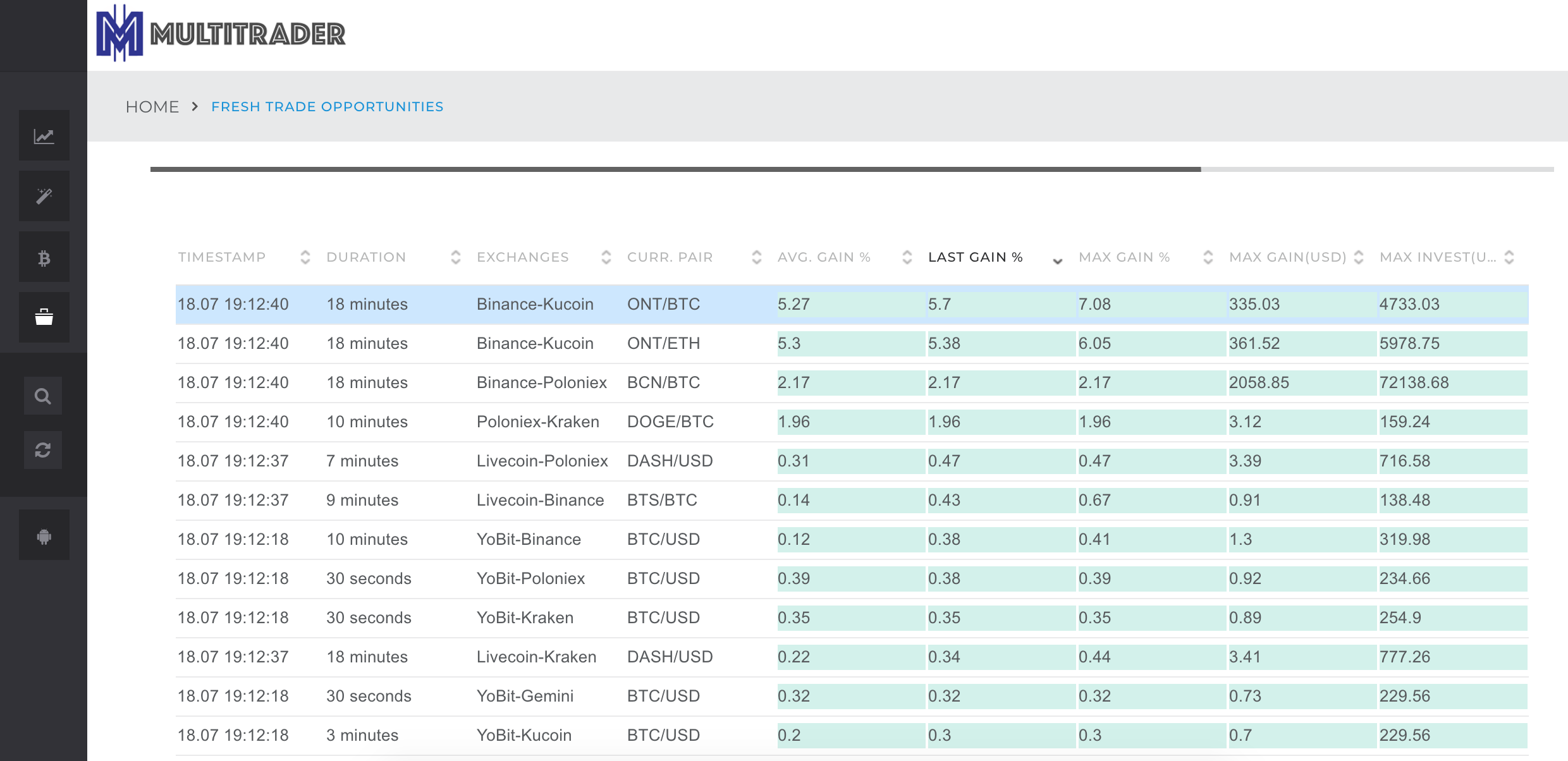

Live arbitrage opportunity streaming

As soon as the platform detects an opportunity for the cryptocurrency arbitrage, user can see it live on the arbitrage opportunity monitor. User can browse through the list of the most recent arbitrage opportunities, sort them and dig into details. As the platform archives all the arbitrage trade opportunities, you can browse through their archives using enhanced search functionality.

Arbitrage opportunity analysis

For each arbitrage opportunity the user can view full analysis including cross-exchange order book matching details.

MultiTrader matches bid orders from one exchange with ask orders from another going from the top of the list as long as the outcome of arbitrage is positive.

Total amount available for arbitrage is the sum of the orders that were matched (these orders are highlighted with yellow on the list).

MultiTrader bots

MultiTrader platform can trade for you using bots. Bot is a program that automates the tasks which in other case would be executed by human. In this case MultiTrader lets you to define the criteria describing the situation when you would like to start the arbitrage trade. As soon as the MultiTrader detects that current situation on the market matches bot conditions, the bot enters the trade for you.

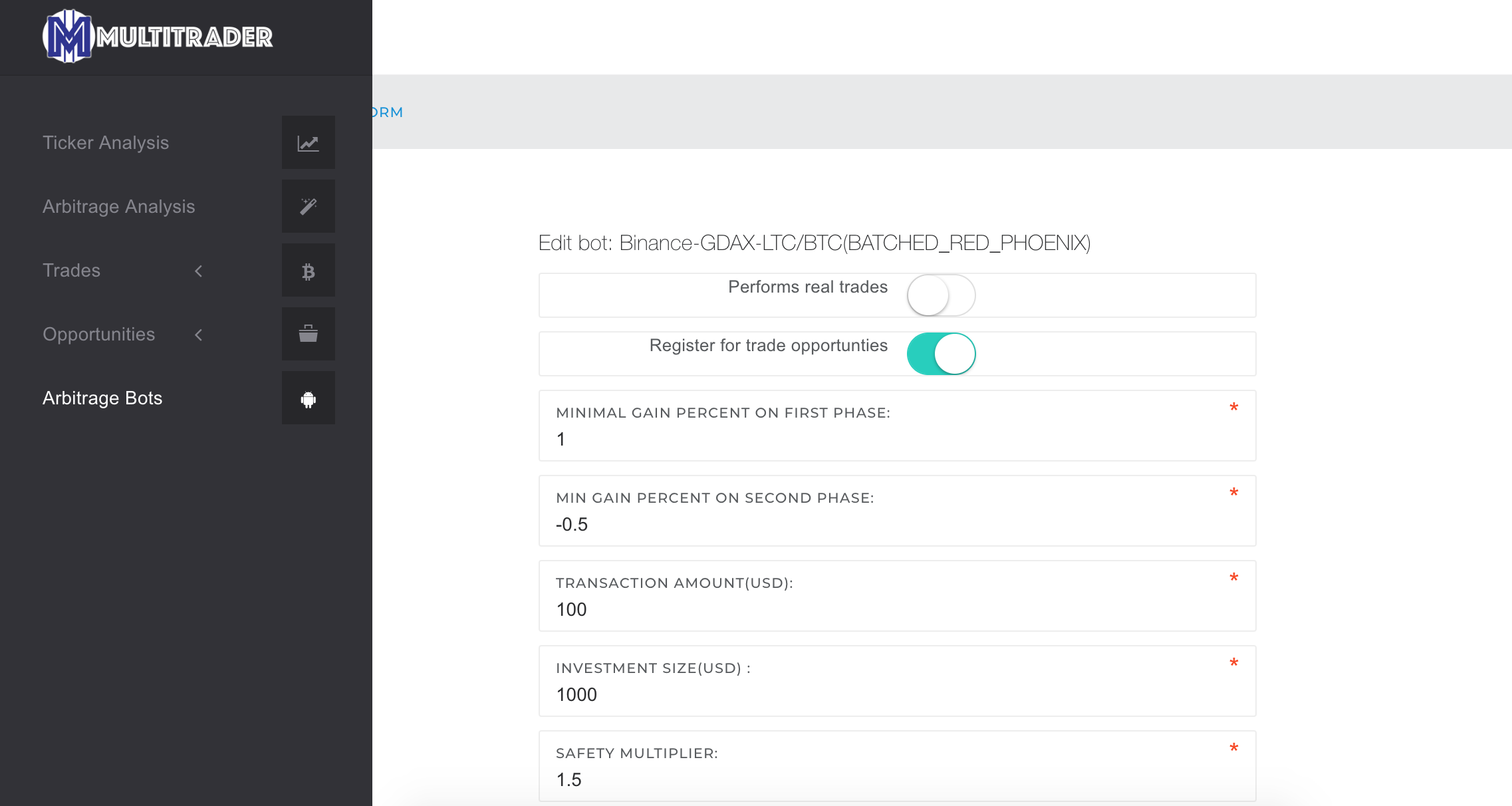

When creating the bot you need to choose the arbitrage strategy and the market (the market in this case is pair of exchanges and cryptocurrency pair on which the bot will be trading). Furthermore you define maximum amount of cash available for bot trading. Other parameters will be dependent on the arbitrage strategy you choose.

Bot assumes you have funds in proper currencies prepared on these exchanges to be used by the bot. Bot performs fund check just before the trade to make sure what amount is available to make sure it can perform the transaction.

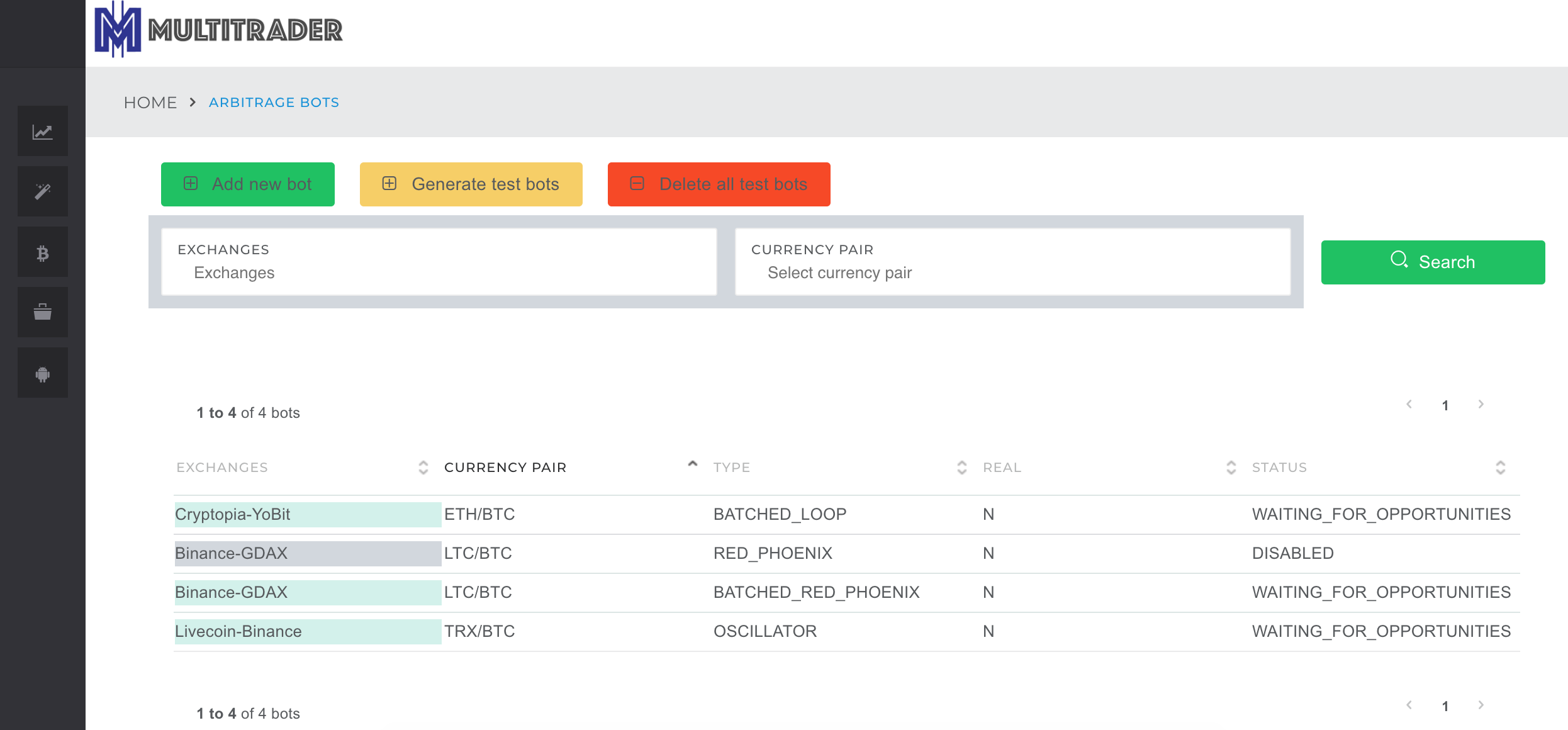

Bot management

MultiTrader provides convenient interface to manage bots. You can create, modify and delete bots. Also, you have the option to create “test bots” – these are “paper trading” bots.

Paper trading bots

Paper trading bot is simply a bot that will not perform real transaction on the exchange. Instead it will “trade on paper” – it will create “paper trade” – a trade that only exists on paper. This is very useful tool to test parameters of your bot, before giving the bot the real funds.

Cryptocurrency arbitrage strategies

MultiTrader allows to use three different arbitrage strategies:

- Red Phoenix – buy when exchanges are far from each other, sell when they get close

- Oscillator – buy when exchange A sells for more exchange B, sell when exchange B sells for more than exchange A

- Loop – buy when exchange A sells for more than exchange B, after using all available funds, transfer funds back to reload the bot

Historical arbitrage analysis

This functionality lets you to analyse historical arbitrage opportunities. MultiTrader stores historical order book snapshots from all the exchanges and can use these snapshots to do historical arbitrage analysis. After specifying the pair of exchanges and the currency pair, MultiTrader does cross-exchange order book matching using its historical order book snapshots. What is important, you need to define the amount of transaction (in USD – it will be converted to the currency you are analysing). The amount is used as a parameter for the cross-exchange order book matching.

Of course the historical arbitrage analysis is performed with the use of default exchange commissions.

The chart presents the gain in % on the arbitrage on given pair. Gain % is calculated as the difference between prices divided by the amount paid on the exchange where we would be buying.

As the trade on two exchanges can be done in two directions – eg YoBit-buy, Kraken-sell (this means buy BTC/USD on YoBit, sell BTC/USD on Kraken) or Kraken-buy, YoBit-sell, you see analysis of both of these directions. The chart is scaled assuming that the positive gain on the arbitrage will occur in the YoBit-buy, Kraken-sell direction. What very often happens, if one direction is positive, the opposite direction will be negative. In this case YoBit-buy, Kraken-sell was positive (green line), but gain on Kraken-buy, YoBit-sell is negative. MultiTrader expresses opposite direction as a loss, therefore the second line, red one is also positive. Positive value of loss, means negative value of gain.

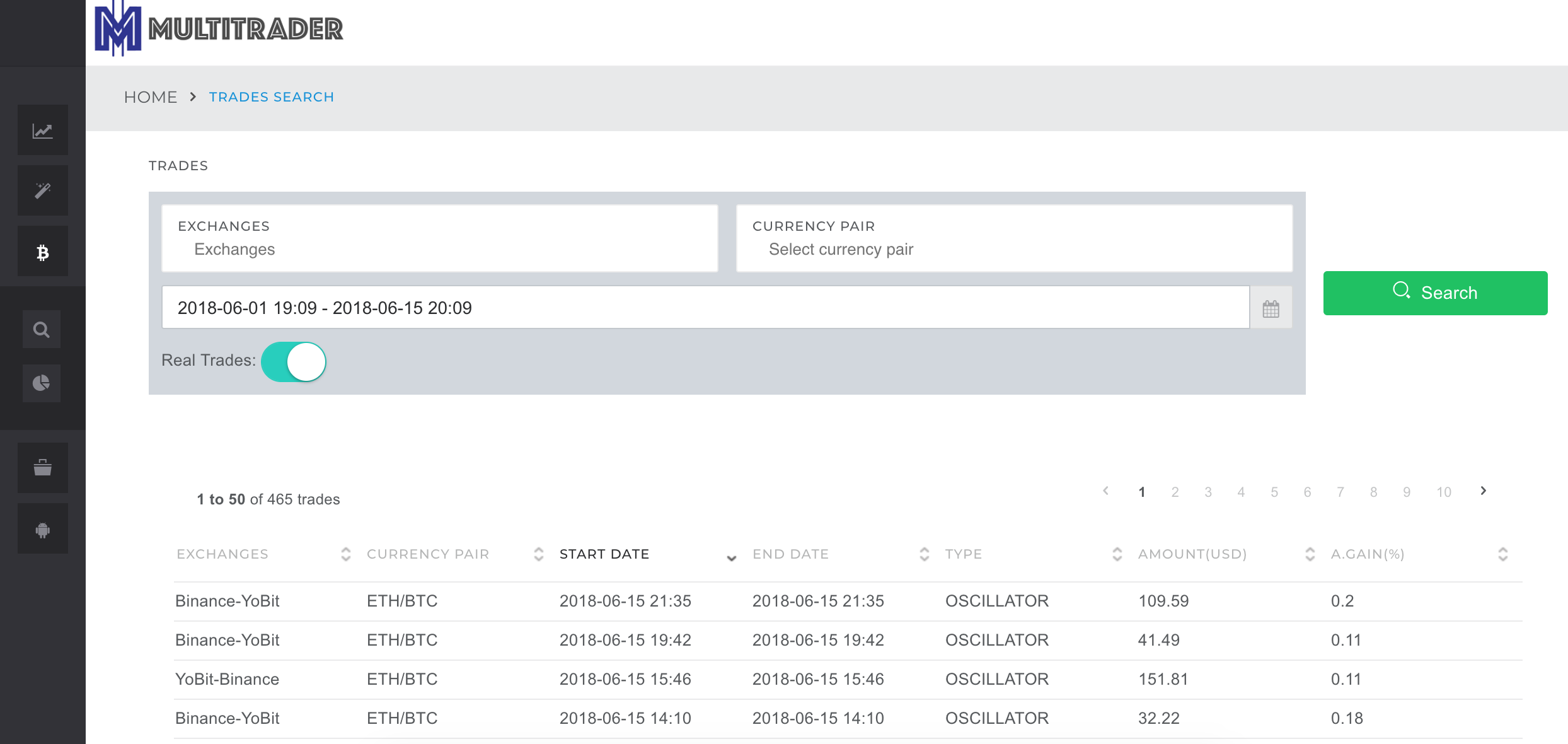

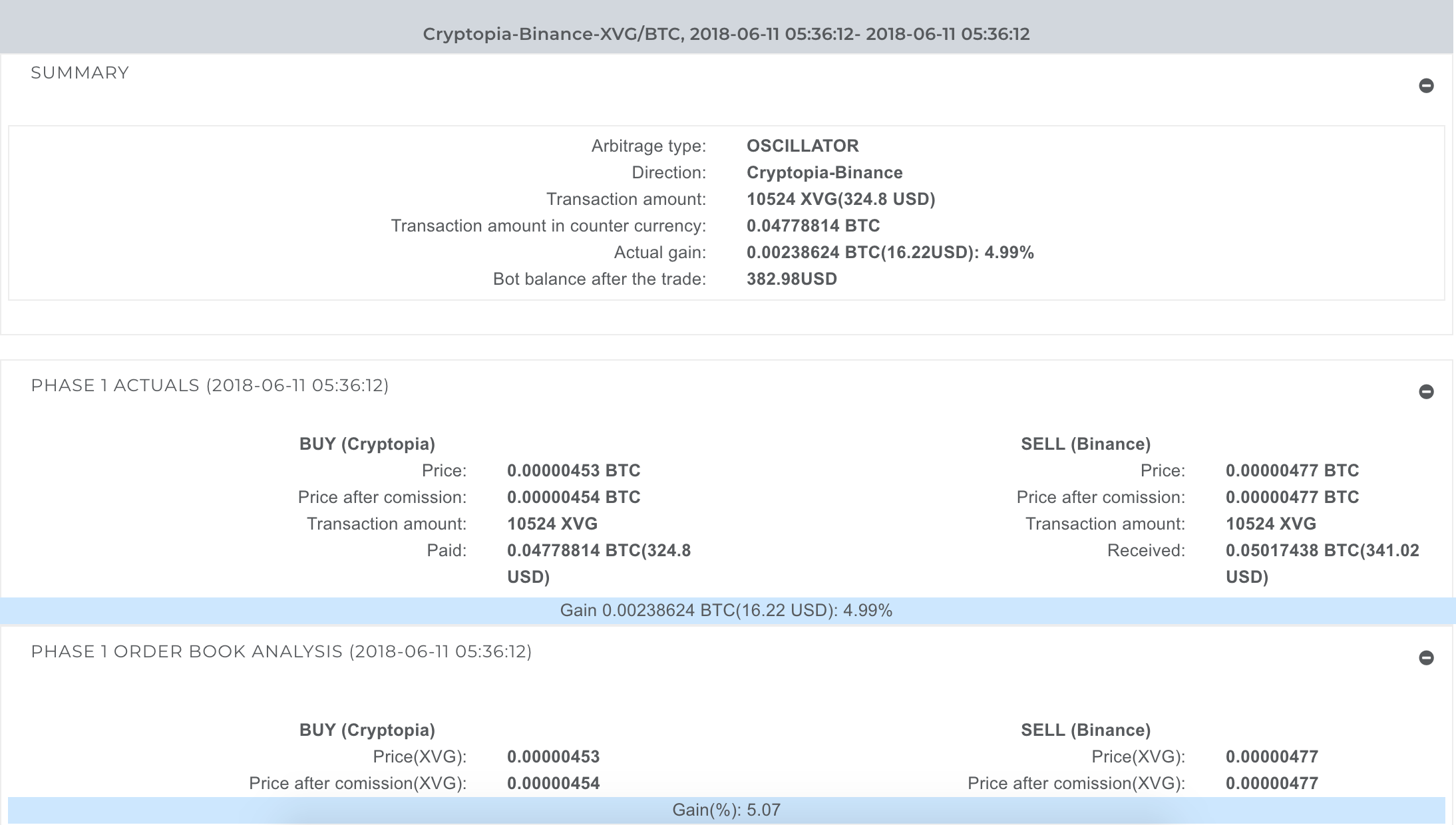

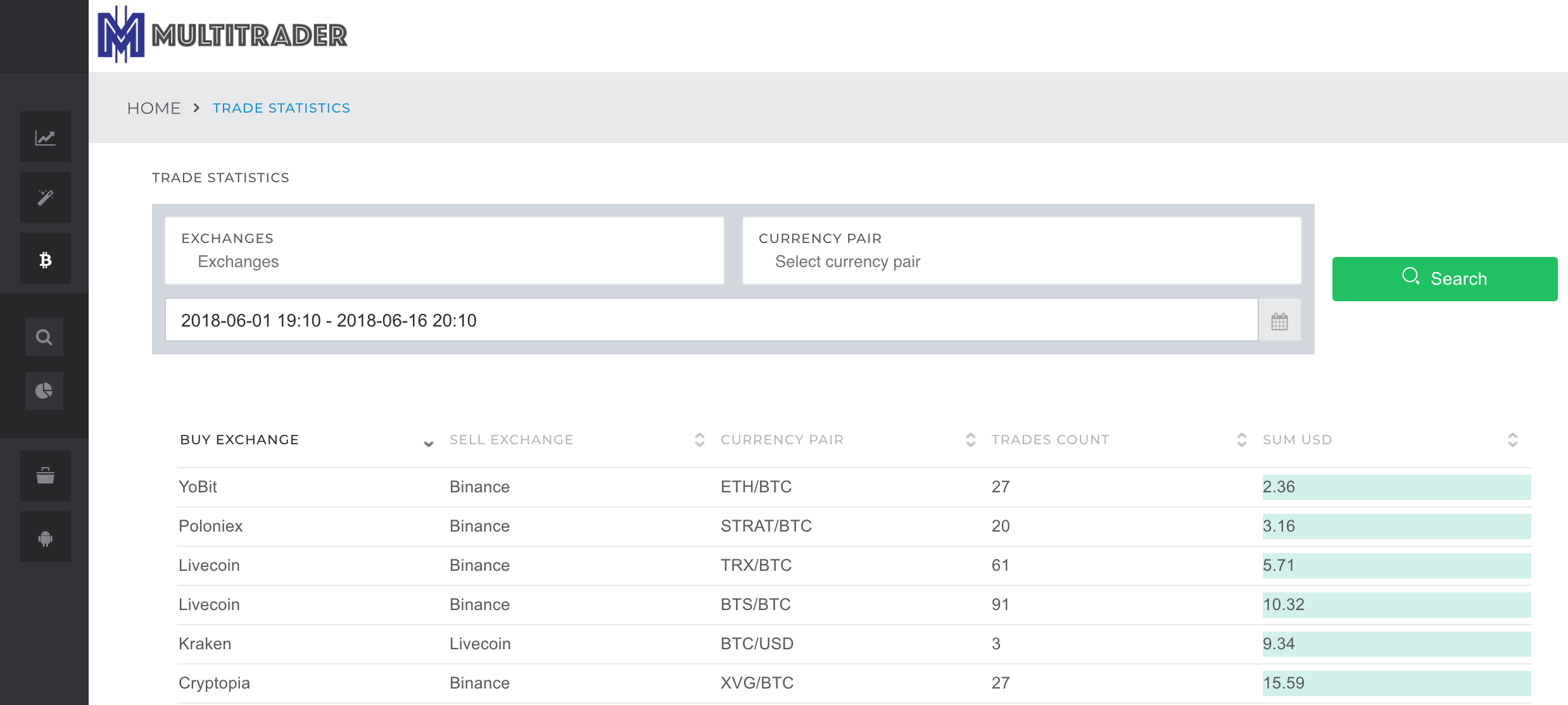

Trade Management

MultiTrader provides you with the tools to monitor your bots and bot trading results. Each bot sends many detailed reports for each trade, however the user interface lets you to browse and search through all the trades, performed with different arbitrage strategies and analyse their details.

Fund management

Platform can track your funds across all the exchanges. Everyday you get summary report for all the exchanges with current indication what is the total value of your assets in USD.

Fund transfers

Platform can transfer your funds across your wallets and track the fund transfer, providing you with the notifications when the funds arrive

Backtester

You can test the parameters of your bots by running them against the historical data. With the use of historical arbitrage analysis, the platform can perform simulation of the trades that would be performed by the bots with the theoretical parameters.

Optimizer

Platform runs backtesting millions of times trying different combinations of bot parameters to find the most optimal settings for your bots. This operation is scheduled couple times a day for all possible combinations of exchanges and currency pairs. You will get detailed analysis of this simulation, so that you could setup your bots based on that result or improve its parameters.

Reporting

User is getting a report after each trade performed by a bot. Also users are getting daily aggregation of the trades, along with the current state of funds on all the exchanges.