Find our full article on Key factors in high frequency crypto trading

Due to or thanks to the fact that each exchange has its own order books and exchanges are separate, geographically distributed entities, the order books between each exchange are different. Differences may be small or huge, they change in time and arbitragers and market makers make sure they don’t exist for too long….

Arbitrage

The difference in price between the exchanges leads to the situations when it pays off to buy an asset in one exchange and sell it for bigger price on another exchange for the price that covers the fees for the orders plus some assumed profit — that is what we call the arbitrage.

Market making with cross-exchange hedging

When we see that the exchange A offers an asset — let’s say 0.01 BTC for the price X that is lower than the price Y on exchange B — we start offering 0.01 BTC on exchange B for the price X + fees + assumed profit. It means we are putting limit order into the books of exchange B and we actively keep adjusting this order when the price on exchange A changes. When our order is filled on exchange B, it means that we sold our BTC for X + fees + assumed profit, we execute market order on exchange A to buy 0.01 BTC for X.

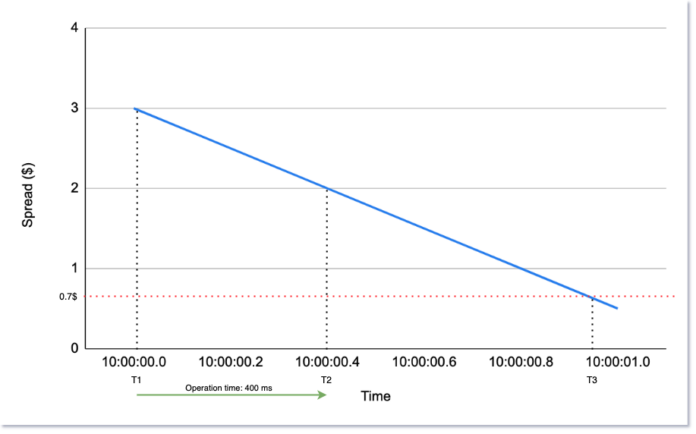

The race for the spread

In both cases everything starts from the difference between the prices on the exchanges. To make things simpler in this example let’s assume that the spread is the difference between the prices in top level entries of the order book

Find our full article on Key factors in high frequency crypto trading